21 July 2025: FATF Releases Updates Reports on TF, PF and Virtual Assets

The Financial Action Task Force (FATF) has recently updated reports concerning Terrorist Financing (TF), Proliferation Financing (PF) and Virtual Assets. The reports contain risk indicators, listing details of flags and typologies that should form part of Operator risk assessments. The reports aim to enhance the readers' understanding of global risks and typologies and support the FATF Global Network in strengthening Anti-Money Laundering, Counter Terrorist Financing, and Counter Proliferation Financing (AML/CFT/CPF) controls in a risk-based and targeted manner.

The reports detail extensive lists of risk indicators for Money Laundering, Terrorist Financing, and Proliferation Financing (ML/TF/PF). The GSC would like to highlight that, as with any risk indicators, many of those noted in the report are broad in nature, and do not in themselves constitute suspicious activity. It is important to bear in mind that in many cases, a single indicator cannot warrant suspicion of TF or provide a clear indication of such activity. However, it could prompt further monitoring and examination, as appropriate. As such, an Operator should read and understand risk indicators relevant to their business and assess if they should prompt further action.

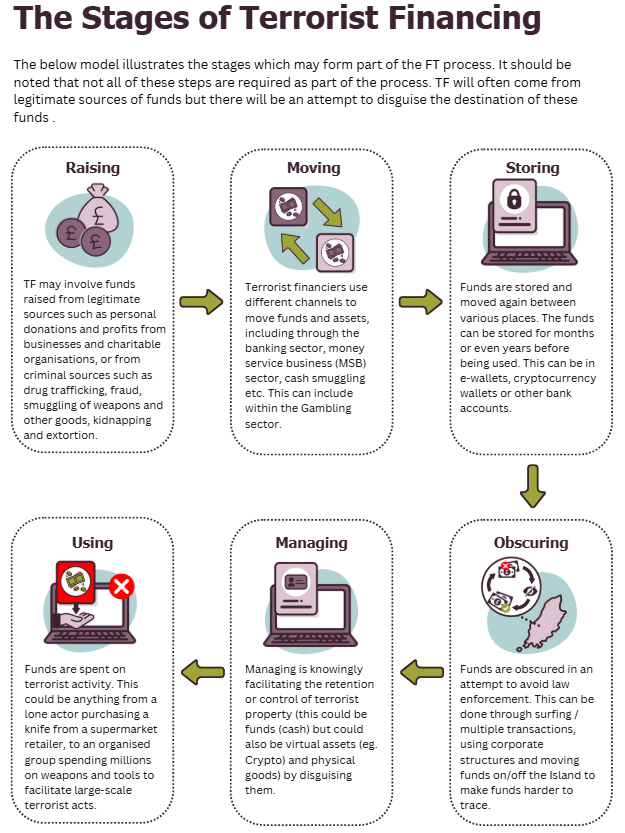

Comprehensive Update on Terrorist Financing Risks

The report provides a detailed analysis of current and evolving TF threats. The report draws on over 840 submissions from private sector, academia, and think tanks; case studies spanning 10+ years; and contributions from 80+ jurisdictions.

With the TF methods varying depending on several factors and contexts, it highlights terrorists’ adaptability, underscoring the need for risk-based counter-terrorist financing measures. The report highlights that unless both public and private sectors urgently enhance technical compliance and effectiveness, individuals seeking to finance terrorism will continue to exploit vulnerabilities.

Overview of Findings

Terrorist groups continue to exploit both traditional and modern financial systems to raise, move, and use funds. The report reiterated that TF methods vary widely depending on context, showing high adaptability.

These methods include:

- Cash smuggling;

- Hawala and informal value transfer systems;

- Online payment platforms;

- Virtual assets (e.g., cryptocurrencies); and

- Abuse of legal entities like shell companies, trusts, and NPOs.

Global Gaps and Deficiencies

It is highlighted that 69% of the (over 200) jurisdictions assessed by FATF and its Global Network show major or structural deficiencies in investigating, prosecuting, and convicting TF cases.

It is noted that many countries lack a full understanding of TF trends, limiting their ability to respond effectively.

Recommendations

- Countries must tailor countermeasures to specific TF risks through a risk-based approach.

- Stronger Public-Private Cooperation needed. Enhanced intelligence sharing and collaboration are essential to countering TF.

- Without improved technical compliance and effectiveness, vulnerabilities will continue to be exploited.

Key Takeaways for the Gambling Sector

- Ensure TF is captured in risk assessments as required by the Code;

- Be aware of Terrorist Financing risk indicators – capture in transaction monitoring systems and communicate through staff training programmes; and

- Carry out effective screening of customers and beneficial owners.

Further Reading

The Isle of Man Government is due to release its Terrorist Financing National Risk Assessment, which will be available on the government website. The TF NRA builds upon the findings of the 2015 and 2020 Money Laundering and Terrorist Financing NRAs and provides a focused analysis of the TF risks relevant to the Isle of Man as an international financial centre (IFC).

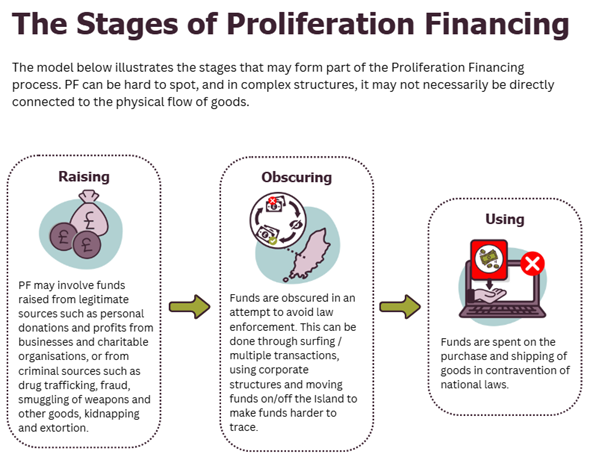

Complex Proliferation Financing Sanctions Evasion Schemes

The report highlights how Proliferation Financing (PF) — the funding of weapons of mass destruction (WMD) — is increasingly facilitated through complex, multi-layered schemes that evade international sanctions. It provides a detailed analysis of the evolving methods and techniques used to evade PF-related sanctions. It also outlines how proliferation networks are sourcing dual-use goods, technologies, and knowledge—often through procurement networks and front companies—and using various financial channels to access the global financial system.

Overview of Findings

The report highlights that actors, such as the DPRK (North Korea), use cyberattacks, front companies, and informal networks to raise and move funds in aid of their regime. This is done through various methods such as the use of Virtual Assets (VA), shell companies, and trade-based money laundering to obscure financial trails.

The report emphasises that only 16% of jurisdictions assessed by the FATF show high or substantial effectiveness in implementing targeted financial sanctions relating to PF (Immediate Outcome 11).

Four major typologies used to evade PF-related sanctions:

- Use of front and shell companies

- Cyber-enabled theft and laundering

- Trade-based money laundering

- Use of virtual assets and informal value transfer systems

Isle of Man Customs and Excise has published a series of detailed documents on Financial Sanctions Guidance in relation to proliferation financing, which the GSC recommends Operators familiarise themselves with.

The GSC also recommends Operators familiarise themselves with the ‘Sanctions relating to PF' webpage on the Isle of Man Government website.

Need for Public-Private Collaboration

The FATF underscore that both the public and private sectors must strengthen technical compliance and improve effectiveness in detecting and disrupting PF schemes.

The report placed Emphasis on information sharing, risk-based supervision, and capacity building. The GSC has been working in partnership with peer jurisdictions and Isle of Man law enforcement agencies to establish and improve existing information sharing capabilities, including expanding its Memorandum of Understanding agreements and putting into place the Gambling Supervision Commission Permitted Disclosures Order 2025. The Order builds upon existing powers, with a particular focus on increasing the circumstances in which the GSC may disclose restricted information to other public authorities in the Island as part of a collaborative all-island approach to countering ML/TF/PF.

Sanctions Screening Challenges

Indirect Links to Designated Entities

Evasion schemes often involve non-designated intermediaries (e.g., front companies, shipping agents) that are not on sanctions lists but are functionally connected to sanctioned actors.

Name Variations and Transliterations

Entities use multiple aliases, misspellings, or different scripts (e.g., Cyrillic, Arabic) to avoid detection.

Inadequate Screening Tools

Some institutions rely on basic or outdated screening systems that fail to detect fuzzy matches or contextual risks.

Lack of Contextual Analysis

Screening often focuses on exact name matches without considering transaction patterns, geographic risk, or sectoral exposure.

Fragmented Data Sources

Screening systems may not integrate shipping data, corporate registries, or customs records, limiting their effectiveness.

Other Key Challenges

Obfuscation through complex corporate structures

- Use of layered ownership, offshore jurisdictions, and nominee directors to hide the true beneficiaries.

- Difficulty in linking transactions to designated persons or entities.

Trade-Based Proliferation Financing

Abuse of legitimate trade channels through:

- False documentation;

- Over/under-invoicing;

- Mislabelling of goods; and

- Involvement of dual-use goods that are hard to detect without technical expertise.

Limited Awareness and Capacity

- Many private sector actors, especially in non-financial sectors, lack:

- Awareness of PF risks;

- Training on red flags; and

- Resources for compliance.

Emerging Technologies

Use of virtual assets, decentralised platforms, and anonymity-enhancing tools to move value covertly.

Key Takeaways for the Gambling Sector

- Screen customers and beneficial owners against sanctions lists.

- Report suspicious activity related to PF or sanctions evasion.

- Understand and mitigate PF risks as part of their AML/CFT framework.

Targeted Update on Virtual Assets (VAs) and Virtual Asset Service Providers (VASPs)

The FATF have also released an update on Virtual Assets. This is the sixth targeted update assessing global implementation of Recommendation 15 (R.15) and its Interpretive Note, which extend AML/CFT obligations to VAs and VASPs.

Overview of Findings

Progress Made

- Many jurisdictions have developed or implemented AML/CFT regulations for VAs/VASPs.

- 99 jurisdictions have passed or are in the process of implementing the Travel Rule.

Persistent Gaps

- Licensing and registration of VASPs remains inconsistent;

- Difficulty in identifying natural/legal persons conducting VASP activities; and

- Offshore VASPs continue to pose significant risks.

Emerging Risks

- Stablecoins are increasingly used in illicit finance, including by DPRK actors, terrorist financiers, and drug traffickers.

- Mass adoption of VAs without consistent regulation could amplify global risks.

Conclusion

The support and cooperation of the public and private sectors are critical in the fight to stop financial crime on a national and international level. Reports such as these enhance situational awareness of intensifying global impacts and implications of transnational crime while also informing regulators of new and emerging threats.

The GSC’s programme of outreach and engagement with key stakeholders will continue to develop in the coming years to keep abreast of developments regarding relevant risks and typologies.

Operators are recommended to keep up to date with new and emerging typologies ensuring any relevant information is also passed onto staff and that policy and procedures are revised as needed.

See the Publications page on the GSC website for factsheets on ML/TF/PF/HT.

Or view the Financial Action Task Force’s publications page to view their reports.